Investment Management

Tapping a Broader Opportunity Set

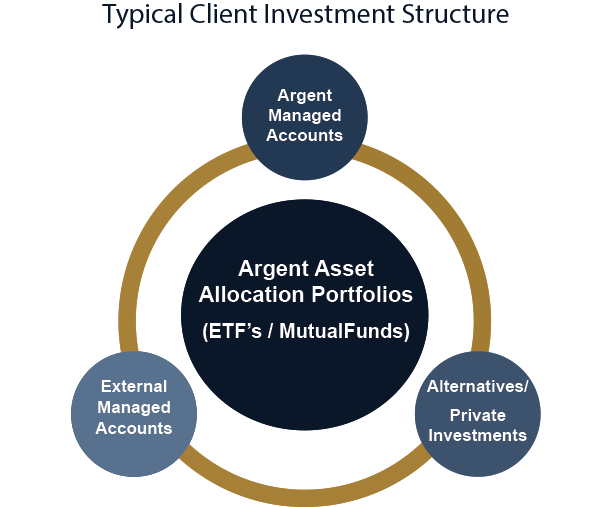

Having invested on behalf of clients for over a quarter of a century, the investment professionals at Argent Wealth Management have a tremendous amount of experience and knowledge. Our investment management team uses traditional and alternative investment strategies to construct diversified portfolios to provide superior risk-adjusted returns in any market environment. Our perspective is global. There are many markets across asset classes around the world. At any given time, some markets are less efficiently priced than others, often due to investors’ emotions and behavioral biases. Lack of efficiency across global markets creates opportunities, but you must have the capabilities and processes to spot and gain from them. We utilize a propriety strategic asset allocation model; stocks, bonds, alternatives (private equity, real estate, hedge funds)– which may provide better returns with less risk than traditional investments only. Furthermore, since our compensation comes from fee-only revenue from clients, our investment process is completely objective. This allows us to focus solely on maximizing after-tax, after-fee returns for you.

Six-person investment team with over 100 years of combined experience.

Team meets formerly on a weekly basis and works collaboratively daily.

When it comes to producing results, we think ACC.

Accountability

Culture

Collaboration

We believe the best results are produced when a diverse set of individuals with different personality types and world views can come together, stay open minded, and uncover what is true using logic and data.

For our internally run asset allocation, equity, and fixed income strategies:

Customized.

Efficient.

Extreme attention to risk and factor exposures. We isolate areas we have the most conviction in.

Collaborative idea meritocracy. Everyone is expected to have an open mind where the best idea wins no matter who or where it comes from.

All decisions backed by consistent data sources.

Combining a quantitative approach with a qualitative approach.

All final decisions are made by our team

As a base for making decisions we use algorithms and multi-factor models where inputs are statistically significant. This keeps our decision framework consistent.

Global approach to maximize opportunity set.

For firms we partner with either as external SMAs, Private Equity, or Private Real Estate:

Trust is paramount.

It is all about understanding the four Ps.

Process

Performance

People

Price

We tend to partner with firms that also want to partner with us as opposed to firms that want to sell us a product.

We demand a direct line to key decision makers with firms we partner with.

We expect our partners to investment meaningfully in their own strategy.

We prefer skilled, differentiated and boutique.